by Latoya Peterson

Please note, this is part three of a multi-part series on the Lifting As We Climb: Women of Color and Wealth report released by the Insight Center for Community Economic Development. Please carefully read part one and review our comment moderation policy before participating in the comments.

I’m fightin for strength, in the street grindin for cents/

I know I’m ahead of my time but I’m behind on my rent/

Askin Kanye for money just to pay on my gas bill/

He asked me for it back, nigga brush up on your math skills/

Nothin plus zip equals zero; he couldn’t relate/

That nigga ain’t been broke since “H to the Izzo”–Rhymefest, “Devil’s Pie“

For many of us who grow up lower middle class or in poverty, the issues began before we were born. Parents struggling to make ends meet rarely find that things get easier once a child arrives – in general, already strained resources are required to stretch even further. Economically devastated parents generally do not have the resources to pass on to their children – indeed, the children may be asked to help participate in taking care of the bills, or once another income is flowing, provide funds to take care of other members of the family.

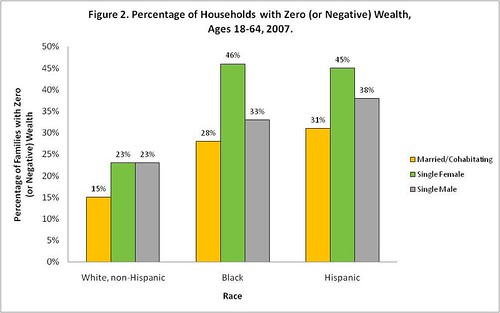

Looking at the chart above, single black and latina female households are hit the hardest by these disparities – but what does it really mean when a household has zero or negative wealth? How does it impact a child’s upbringing and future?

I’ve been reading Anya Kamenetz’s DIY U: Edupunks, Edupreneurs, and the Coming Transformation of Higher Education (more on this when we get into the debt section of the report) and her discussion of the interlocking issues involved are fascinating. Kamenetz reveals that starting out low income tends to have a dire effect on all parts of your life course, including getting into college:

A 2006 study found that the highest achieving students from high-income families – those who earned top grades and took all the AP courses – are nearly four times more likely than low income students with the same academic accomplishments to end up in a highly selective university.

And once students – at all levels – begin to attend college, income constraints figure heavily into whether someone will have the financial support necessary to finish school. Kamenetz interviews Wick Sloane (a professor at Bunker Hill Community College, contributor to trade mag Inside Higher Ed, and advocate for abolishing the four year bachelor’s degree) who explains that money is a major issue – but not in the way many educators think:

“Many people think, and I might have been guilty of it, that we need $25,000 per year per student and that’s what it takes to get through college. But really it’s very often $50 problems that knock them out: a car breakdown, a dental bill, a changing shift in their job. So really helping these students, as a policy matter, is a lot cheaper than people think.”

The students Sloane refers to are the ones lacking an economic safety net. With family wealth, a student can receive a loan or loner vehicle from their families, have a parent pay for needed dental work, or choose to focus solely on their studies instead of working. For those who grow up in households with zero or negative wealth, often those problems are not solved.

Even after college, the disparities continue to mount. I was always amazed at the friends who could rely on parental support during tough times, who could impulsively make a decision to spend a year backpacking, or leave their job and return to school with no prior savings. And these issues continue into the homes of the children, now adults, who may be called upon to help support family members even further due to on the job accidents, job loss, workplace discrimination (heightened for older, less-skilled adults), or chronic illness. Often the quest to climb out of poverty is a long uphill battle – not only is it up to the individual to make smart financial choices, but often to make these decisions while supporting others. As Sloane explains, it’s often the $50 dollar problems that derail someone on the path to financial stability.

So what kind of solutions can we find to solve the miscellaneous misfortunes of every day life?

Friday: Measuring The Intangibles.

The post Women of Color and Wealth – Starting Points and Class Jumping [Part 3] appeared first on Racialicious - the intersection of race and pop culture.